The Trading Pit aims to revolutionize the global trading and investing landscape by equipping traders with the necessary knowledge and tools to become successful partners. Their collaborative approach emphasizes mutual growth, creating a symbiotic relationship between the firm and its traders.

Incorporated in February 2022, The Trading Pit Challenge GmbH operates from Vaduz, Liechtenstein, with additional offices in Limassol, Cyprus, and Alcobendas, Madrid. Led by CEO Thomas Heyden, this proprietary trading firm partners with FXFlat and GBE Brokers, offering a streamlined, one-step evaluation process for traders.

Daniela Egli, CEO of The Trading Pit, brings over fifteen years of experience in the Financial Services Sector, holding senior roles in business development, executive management, and compliance across Asia and Europe. Her career highlights include leadership positions at Skilling, FXview, and Blackwell Global, where she significantly contributed to their growth and global expansion. Daniela’s extensive certifications, including CySEC Advanced and AML, CISI risk management, and Level 1 CFA, enhance her expertise. At The Trading Pit, she leverages her strategic vision and operational excellence to drive the firm’s mission of providing exceptional support to traders and partners, ensuring transparency and client satisfaction.

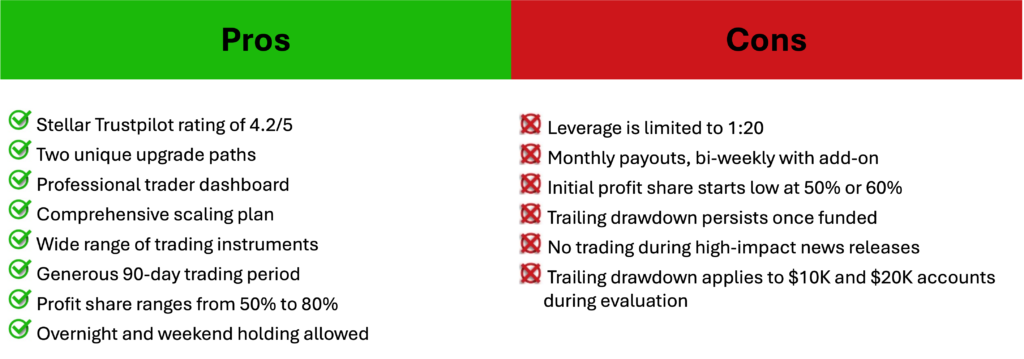

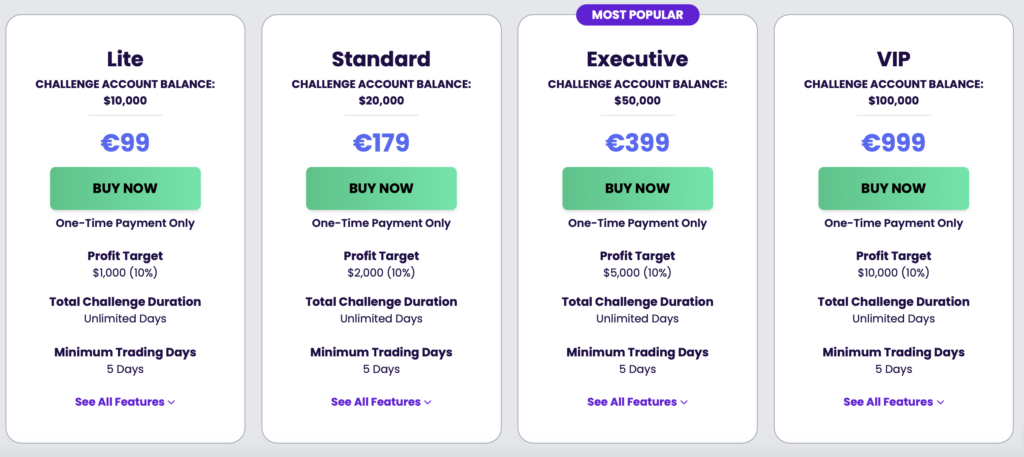

The Trading Pit’s primary funding program, the CFD Challenge, offers traders the chance to manage accounts from $10,000 to $100,000 with leverage up to 1:20. Successful traders must reach a 10% profit target (or 8% for $100k accounts) within a 90-day evaluation period while adhering to strict risk management rules.

Scaling Plans: The program includes several scaling plans:

Profit Target – Traders need to achieve a specified profit percentage to complete the evaluation phase, withdraw earnings, or scale their trading account. The profit target is 8% or 10%, based on the initial account size. Funded accounts also require an 8% or 10% profit target to withdraw and scale the account balance, depending on the initial account size.

Maximum Daily Loss – This is the maximum amount a trader can lose in a single trading day without breaching the account, set at 5% for all account sizes.

Maximum Loss – This is the overall maximum loss a trader can incur without breaching the account. For $50,000 and $100,000 accounts, this limit is set at 10%.

Maximum Trailing Loss – This represents the difference between the highest account balance achieved and the lowest point of the drawdown, capped at 10% for $10,000 and $20,000 accounts.

Minimum Trading Days – This is the minimum number of days a trader must engage in trading to successfully complete the evaluation phase, set at 3 days.

Maximum Trading Period – This is the total duration within which a trader must achieve the profit target and complete the evaluation phase, capped at 90 calendar days.

No News Trading – Trading is prohibited during high-impact news releases. This means no new trades can be executed or existing trades closed within 2 minutes before and after the announcement of specified news.

The Trading Pit distinguishes itself by offering a single account type with a straightforward, one-step evaluation process. Noteworthy features include a 90-day trading period, reduced minimum trading days, unique upgrade options, and a scaling plan that extends up to $5,000,000. These attributes set it apart from other proprietary trading firms.

The Trading Pit’s CFD Challenge is accessible due to its moderate profit targets and flexible loss rules. With a maximum trading period of 90 days and minimum trading days requirement, traders can realistically achieve the objectives and enjoy profit splits ranging from 50% to 80%.

The Trading Pit has garnered positive feedback on platforms like Trustpilot, with an impressive 4.2 out of 5 rating from 344 reviews. Successful traders frequently share their experiences and payment proofs on the firm’s Discord and YouTube channels, attesting to the firm’s reliability and transparency.

The Trading Pit collaborates with FXFlat and GBE Brokers, both reputable brokers offering high standards of service. Traders have the flexibility to use MetaTrader 4 or MetaTrader 5 platforms, ensuring a robust trading experience.

The Trading Pit offers a comprehensive suite of educational tools, including eBooks, webinars, podcasts, videos, and more. Their well-developed trading dashboard and various live statistics help traders track their progress efficiently.

The Trading Pit stands out as a reputable proprietary trading firm with realistic trading objectives, favorable conditions, and comprehensive support. Their unique funding program and scaling plans cater to traders of all styles, making them a top choice in the prop trading industry. Whether you’re a novice or an experienced trader, The Trading Pit offers an exceptional platform for growth and success in the trading world.